Concerns over the potential impact of shifting global trade trends on inflation pressures have emerged during the annual conference of central bankers held in Jackson Hole, Wyoming. Experts have indicated that these trends might intensify inflationary pressures worldwide in the coming years, posing challenges for central banks like the Federal Reserve.

For decades, the global economy saw increased integration, leading to the flow of goods between the United States and its trading partners. This setup allowed cheaper goods due to overseas production, but it also led to job losses in American manufacturing.

However, the pandemic triggered a reversal in this trend, with multinational companies moving their supply chains away from China. This shift is encouraged by substantial subsidies from the Biden administration and includes the increased production of crucial items like semiconductors within the United States.

Renewable energy investments also come into play, potentially causing temporary disruptions due to heightened government borrowing and material demand, thus increasing inflation.

The ageing global population further compounds the issue as older individuals tend to work less, potentially leading to supply shortages akin to those observed during the post-pandemic recovery phase.

Christine Lagarde, President of the European Central Bank, highlighted that this new environment might result in larger relative price shocks than before the pandemic. Such shocks could be particularly pronounced in commodity markets, including metals and minerals required for green technologies.

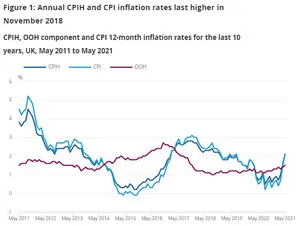

This scenario complicates the tasks of central banks like the ECB and the Federal Reserve, whose responsibility is to manage inflation. These institutions have been struggling with elevated inflation levels since early 2021.

The shifts in global trade patterns took centre stage at the Jackson Hole conference. Notably, China’s share of U.S. imports declined by 5% from 2017 to 2022.

This change was attributed to U.S. tariffs and companies seeking alternative sources of goods after China’s pandemic-induced shutdowns. Import sources like Vietnam, Mexico, and Taiwan gained prominence, showcasing a trend known as “friendshoring.”

While trade patterns are undergoing transformation, overall U.S. imports reached record highs in 2022, suggesting continued robust trade.

Despite these shifts, there are indicators of “reshoring,” or the return of production to the United States. The decline in U.S. manufacturing jobs appears to have stabilized, and increased imports of parts and unfinished goods suggest more domestic final assembly. However, these changes also contribute to inflation, as the cost of goods from countries like Vietnam and Mexico has risen in recent years.

Additionally, China’s weakening economic growth might exert downward pressure on global commodity costs. However, concerns over rising defaults in China’s property sector have been highlighted as a significant factor in its growth slowdown.

The conference also saw criticism of subsidies supporting domestic manufacturing, with warnings that indiscriminate use could lead to inefficiency. Advocates of globalisation stressed its role in restraining inflation and reducing poverty, emphasising its positive impact on economic activity.

In conclusion, the shifting landscape of global trade patterns presents a complex mix of challenges and opportunities for central banks and economies worldwide, influencing inflation dynamics and economic strategies in the years ahead.